See This Report on Ach Payment Solution

Wire transfers are likewise more pricey than ACH repayments. While some financial institutions don't bill for wires, in many cases, they can cost customers up to $60. EFT settlements (EFT stands for digital funds transfer) can be used reciprocally with ACH settlements. They both describe the same settlements mechanism.:-: Pros Cost: ACH settlements have a tendency to be more affordable than cable transfers Rate: faster considering that they do not utilize a "batch" procedure Cons Speed: ACH repayments can take a number of days to process Price: relatively pricey source: There are 2 kinds of ACH settlements.

ACH credit transactions allow you "press" cash to various banks (either your own or to others). Right here are two instances of how they function in the wild. Numerous firms provide straight deposit pay-roll. They use ACH debt transactions to press cash to their workers' checking account at designated pay durations.

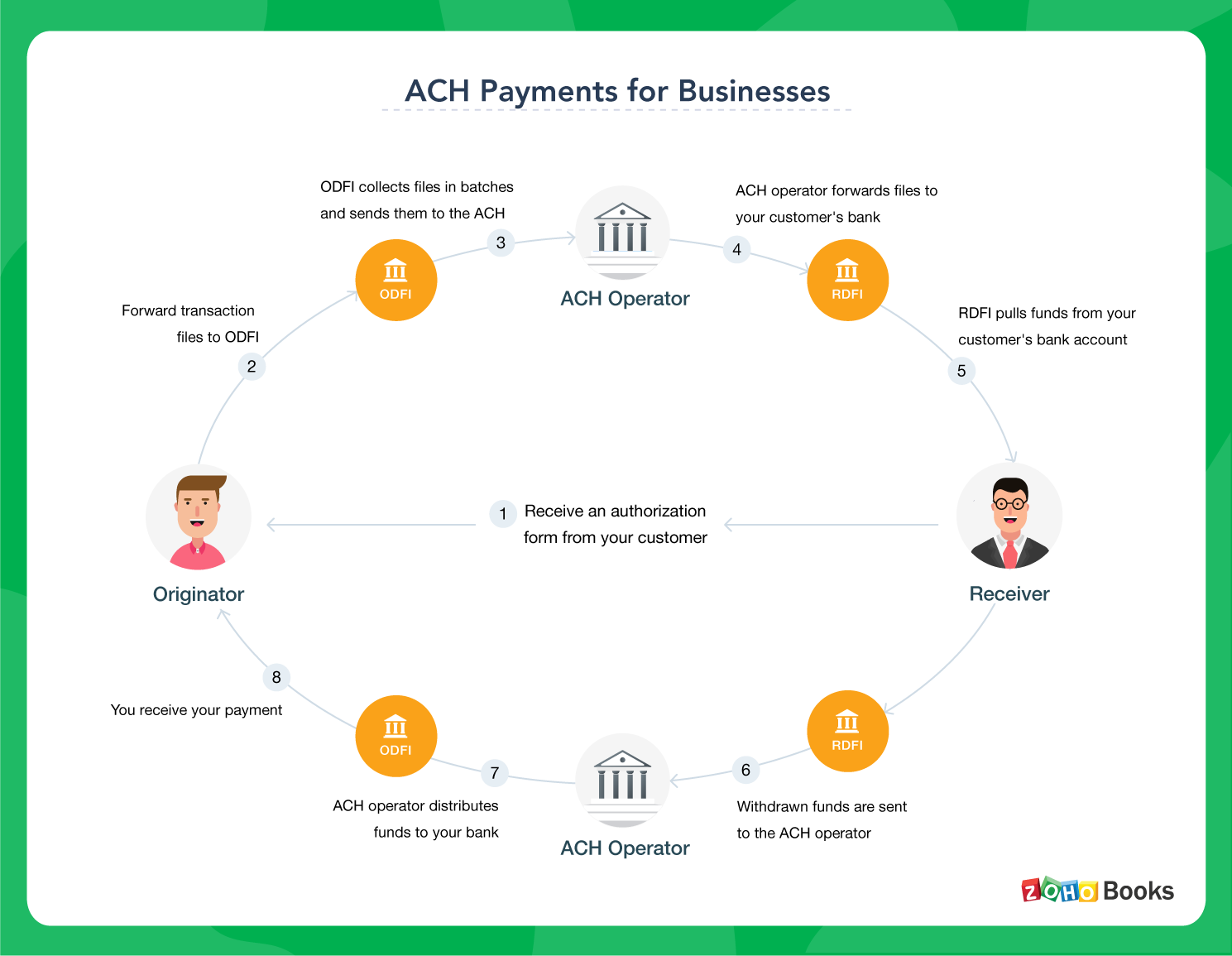

Customers that pay an organization (claim, their insurance coverage carrier or home mortgage lending institution) at specific intervals might choose to register for persisting repayments. That provides the organization the capability to initiate ACH debit transactions at each billing cycle, drawing the amount owed directly from the customer's account. Besides the Automated Clearing House network (which connects all the financial institutions in the USA), there are 3 various other players associated with ACH payments: The Originating Vault Financial Organization (ODFI) is the banking establishment that launches the deal.

A Biased View of Ach Payment Solution

(NACHA) is the nonpartisan governmental entity accountable for overseeing and controling the ACH network. When you authorize up for autopay with your phone business, you offer your monitoring account details (directing and account number) as well as authorize a reoccuring settlement authorization.

Both banks then interact to make certain that there suffice funds in your savings account to refine the purchase. If you have enough funds, the purchase is processed and the cash is routed to your phone business's savings account. ACH settlements typically take a number of service days (the days on which banks are open) to undergo.

Per the standards set forth by NACHA, banks can pick to have actually ACH credit ratings processed as well as delivered either within a company day or in one to 2 days. ACH debit transactions, on the various other hand, have to be refined by the following company day. After getting the transfer, the various other financial institution may also detain the transferred funds for a holding duration.

Nonetheless, a brand-new rule by NACHA (which entered into result in September 2016) needs that the ACH process debits 3 times a day as opposed to simply one. The adjustments (which are happening in phases) will implement extensive use of same-day ACH repayments by March 2018. ACH repayments are normally much more affordable for companies to procedure than bank card.

Things about Ach Payment Solution

Some ACH processors bill a level price, which generally varies from $0. 25 to $0. 75 per deal. Others charge a level percentage cost, varying from 0. 5 percent to one percent per transaction. Suppliers might also bill an additional regular monthly fee for ACH settlements, which can vary. Continued Square makes use of ACH payments for down payments, as well as there's no cost related to that for Square vendors.

These reject codes are necessary for providing the ideal info to your customers as to why their repayment really did not experience (ach payment solution). Below are the 4 most usual turn down codes: This means the client didn't have adequate money in their account to cover the quantity of the debit entrance. When you get this code, you're probably going to need to rerun the deal after the client transfers even more cash right into their account or supplies a various payment technique.

It's most likely they forgot to alert you of the adjustment. They have to offer you with a new savings account to refine the deal. this link This code is triggered when some combination of the data offered (the account number as well as name on the account) doesn't match the financial institution's documents or a missing account number was gotten in.

In find more information this case, the customer requires to provide their financial institution with your ACH Producer ID to enable ACH withdrawals by your organization. Declined ACH payments can land your service a charge cost.

An Unbiased View of Ach Payment Solution

To prevent the headache of untangling ACH rejects, it might be worth just approving ACH repayments from trusted consumers.

That suggests you can not send or obtain financial institution info via unencrypted email or insecure internet types. Ensure that if you use a 3rd event for ACH settlement processing, it has actually carried out systems with cutting edge encryption approaches. Under the NACHA rules, originators of ACH settlements need to additionally take "readily affordable" steps to make certain the credibility of consumer identity as well as directing numbers, as well as to recognize possible illegal activity.

Comments on “5 Simple Techniques For Ach Payment Solution”